The campaign to change the Tennessee beer tax is going gangbusters. In fact, there’s another campaign rally in Knoxville, Tenn., tonight, following last week’s successful Memphis, Tenn., rally. But tax law is complicated. If you’re looking to get involved, here’s a rundown of Tennessee beer tax facts from the Fix the Beer Tax campaign to arm yourself with before you hit the campaign trail or just talk to the guy sitting next to you at the bar.

- Tennessee has the highest beer tax in the country, and because it is largely based on price, not volume, it will continue to keep growing and growing unchecked.

- Tennessee’s beer tax rate uses the barrel as its standard rate of measure. A barrel is 31 gallons of beer. That beer can be sold by the can, bottle, case or keg, but as far as the taxes are concerned, the rate is based on the barrel.

- Tennessee’s system has three main elements in its beer-tax structure. State and federal excise taxes are based on volume. The 17-percent local wholesale beer tax is based on price. Kentucky is the only other state that includes a price-based tax, although that rate is far lower than Tennessee’s.

- The price-based portion of the beer tax — a 17-percent tax — goes to Tennessee’s cities and counties, generating more than $125 million in revenue for those communities in 2011.

- In the same year, the state excise beer tax generated $16 million, and the federal excise beer tax paid in Tennessee was $69 million.

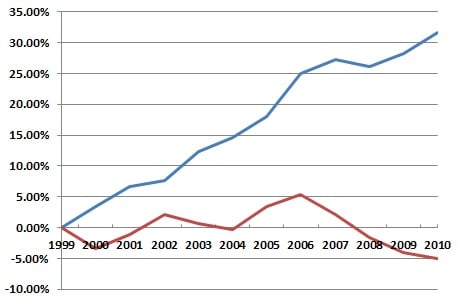

- For the past decade, beer sales have declined by five percent in Tennessee, but the local wholesale tax revenues have climbed rapidly, up more than 30 percent.

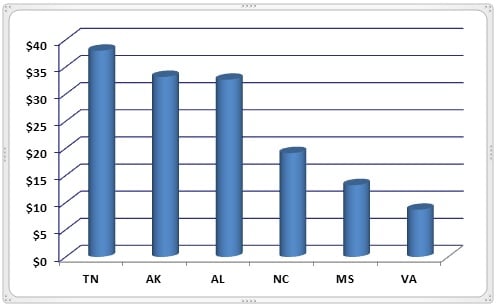

- Tennessee surpassed Alabama in 2007 to become the second highest beer-tax state behind Alaska.

- Tennessee became the state with the highest beer tax rate in the country in 2008, overtaking Alaska.

- Higher price-point beers are taxed higher, which unfairly penalizes Tennessee’s young craft brewing industry.

- These policies also directly affect more than 2,500 Tennesseans, from small distributors that employ 25 to wholesalers employing 250. These are Tennessee-owned businesses that have been contributing to their communities for generations.

The solution, according to the Fix the Beer Tax campaign? Adopt a volume-based system, similar to those in 48 other states. If the tax system was based solely on volume, as proposed by the Beer Tax Reform Act of 2013, Tennessee would still have the nation’s highest effective beer tax rate. Cities and counties would not see a decrease in beer-tax revenues. The Tennessee Beer Tax Reform Act of 2013 would halt the rocketing tax-revenue rise that has accompanied with a price-based, local wholesale tax.

Now you’re ready to hit the campaign trail, press the flesh and bring down beer taxes for all those Tennessee beer brewers and lovers.

Great post from @craftbrewingbiz about the TN beer tax facts. Check it out and get informed at http://t.co/mv7Irs6O.