Data and analytics company GlobalData says three new trends are emerging in the alcoholic beverage space as a result of the COVID-19 pandemic: altered social lives, their view of brands, and their awareness of health and wellbeing.

Its latest report, ‘Coronavirus (COVID-19) Case Study: Alcoholic Beverage Innovation’, GlobalData notes that the scale and impact of the global health crisis has changed consumers’ consumption habit and sentiments toward fast-moving consumer goods (FMCG) brands, which is inevitably influencing the alcoholic beverage industry.

GlobalData looks at these three emerging trends:

New socializing norms

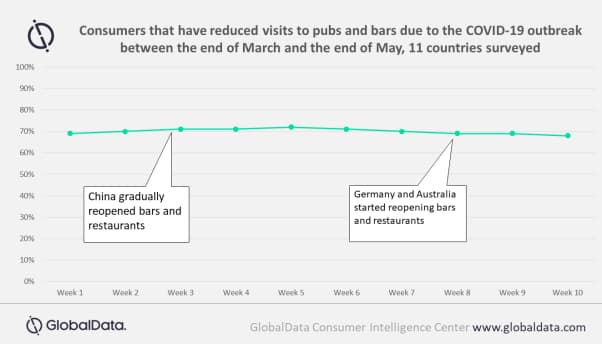

Home consumption has increased due to the closure of pubs and bars. At the end of May (Week 10), 68% of consumers in 11 countries surveyed said they had stopped or reduced visits to pubs and bars due to the outbreak of COVID-19. This figure remained relatively steady during the 10 weeks from March 25 to May 31, in which GlobalData’s survey was held, despite some countries re-opening up bars and clubs – for example, China gradually re-opened bars on early April and Germany and Australia opened up on May 15. The analysts think this trend is likely to continue even as more outlets reopen.

“As more people avoid bars and clubs, alcoholic beverage manufacturers need to consider consumers’ ‘New Socializing’ occasions such as home drinking in product development,” said Mitsue Konishi, Senior Innovation Analyst at GlobalData. “One key consideration will be catering to premium and budget-friendly alcoholic innovations to allow consumers to capture the bar-quality drinking experience at home. In particular, flavoured alcoholic beverages such as ready-to-drink cocktails are already growing, seeing 12% increase in volume sales globally compared with 2018 and 2019**. Premiumization in this category is likely to see opportunity here.”

One of the rising concerns among consumers is money constraints. Young age groups (e.g. 25-34) are price sensitive, and GlobalData’s latest survey shows 13% of millennials globally have stopped buying alcoholic drinks because it is beyond their shopping budget, while 20% say they are buying these products at the lower end of the price range (fieldwork dates August 5-9). Discounter ALDI has launched hard seltzer Nordic Wolf in the UK with a low price point of £1.29 – half the price of cult brand White Claw, which sold at £2.50. Trending innovation in the affordable price range cannot be ignored to appeal to these consumers.

New initiatives

This one relates to innovation, like when alcoholic drink manufacturers started supplying their alcohol ingredients to produce sanitizers.

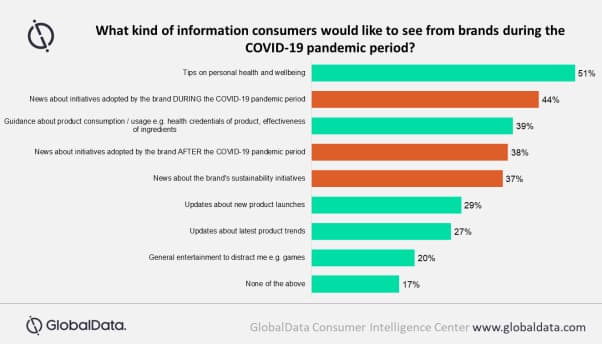

“These activities will influence their purchase decisions in future,” Konishi continues. “A sizeable number of consumers are expecting to see initiatives taken by brands during the pandemic, as well as after the pandemic, while 37% of consumers are specifically seeking brands’ sustainability initiatives. Therefore, proactively taking new initiatives is likely to become a key marketing activity for brands.”

Health interest

The health trend is one that alcoholic drink manufacturers cannot ignore. The global health crisis has raised consumers’ concerns about their health – physically and mentally. ‘Better-for-you’ has been a key alcohol drink innovation trend for a few years, but this aspect will become more important than ever among consumers.

“Young age groups are concerned about their health more than older groups, and these concerns are reflected in their shopping choices,” Konishi adds. “Alcoholic beverages with positive health attributes such as low calorie and sugar content will appeal to these health-conscious consumers. As mentioned earlier, hard seltzers are trending, as they have these healthier attributes which help to position them as an aspirational drink.

“Furthermore, young consumers also are highly aware of mental wellbeing. For those, alcohol-free alternatives have potential as an aspirational beverage but without the adverse impacts of alcohol. Thus, low or no alcohol alternatives are likely to see even further growth this year.”

Leave a Reply

You must be logged in to post a comment.