This question comes up a lot: How do I create a financial feasibility plan for my brewery? In other words, how do you know if the brewery will make enough money to be financially successful? Enough to pay the bills, cover the loan payments and provide good wages for owners and employees.

This question comes up a lot: How do I create a financial feasibility plan for my brewery? In other words, how do you know if the brewery will make enough money to be financially successful? Enough to pay the bills, cover the loan payments and provide good wages for owners and employees.

In this post, we’ll cover the four major parts of a financial feasibility plan and how to build them. This plan will arm you with the information needed to answer the financial questions for your brewery.

- Sources and uses plan

- Sales and margin forecast

- Operating expense schedule

- Loan payments and EBITDA

Note: To help you create a financial plan for your brewery, I put together a full spreadsheet model and a 30 minute video with step-by-step instructions. Get this as a free bonus when you sign up as an annual subscriber (do that right here).

Sources and uses plan

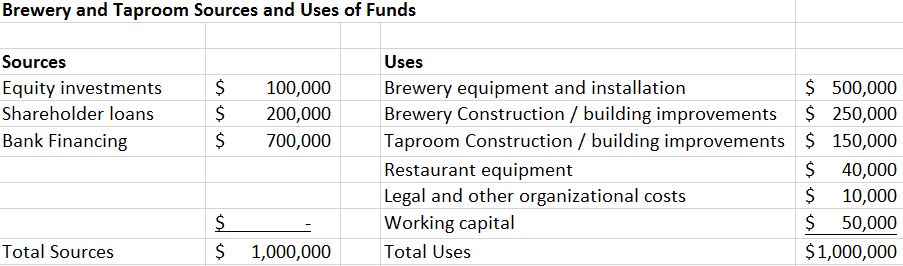

The sources and uses plan is a listing of where capital will come from and where it will be spent. It’s one of the first things a bank will ask for and it’s a useful planning tool to make sure you have enough cash for your project. Sources are the funds needed for the brewery. This includes equity that you put in, shareholder loans and bank financing. Uses are how you will spend the funds. Brewing and packaging equipment, tanks and working capital go here.

When you build the sources and uses schedule, you will have a simple listing of what you need to spend money on and where that money will come from. The rest of the plan will help you determine how you pay back the money borrowed and provide a return on investment for the equity you put in. Here’s an example of a sources and uses schedule:

Sales and margin forecast

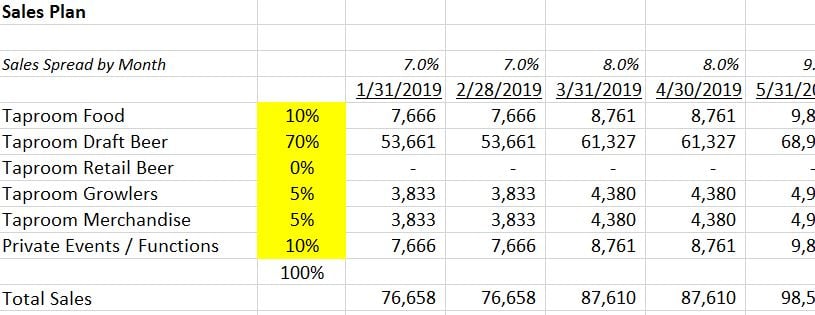

The sales forecast is where most financial plans start (and often end). The main question is: How much beer can you sell, and how much can you make on each sale?

To begin, list out the expected revenue streams: taproom sales, self-distribution and wholesale beer sales. Next, build up a schedule to support each revenue stream. For startups or breweries with little sales history, the sales plan will include assumptions and industry benchmarks. The taproom sales plan will start with an assumption of customer traffic multiplied by an industry average of customer spend per visit. For example, 1,000 customers per week times an average spend of $18 per customer = $18,000/week sales.

The self-distribution sales plan requires information about the market you will serve: Number of licensed accounts, number of craft beer accounts where your beer will fit, number of on premise and off premise locations, etc. Once you’ve determined how much beer you can sell (on paper), it’s time for the margin forecast. The margin forecast will show how much you can make on each beer sale. Margin is the difference between the sales price of the beer and the cost of the beer.

Operating expense schedule

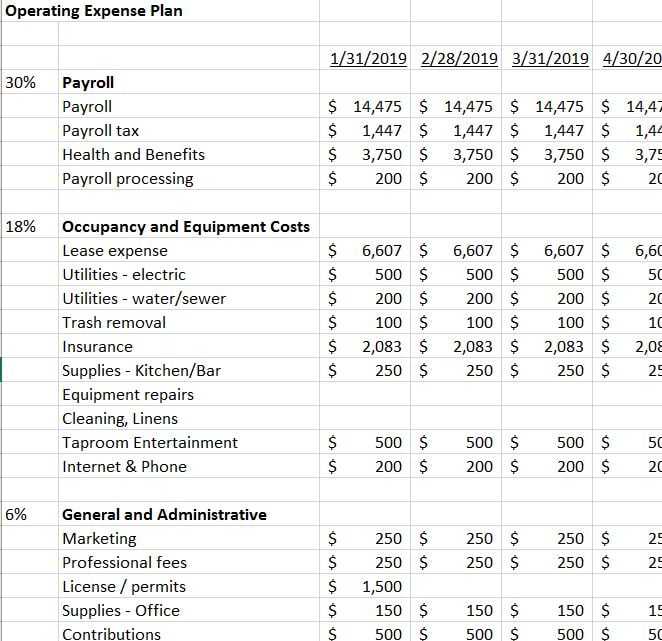

The operating expense schedule is a listing of all the day to day costs to run the brewery. These include payroll, taxes, lights, heat, power, insurance, and so on. The first step is to list out all the things you’ll need to spend money on and estimate the annual total of each.

For example, if you have a leased space with 5,000 square feet and pay $12 per foot, the lease expense will be $60,000 per year or $5,000 per month. The items on the operating expense list will vary depending on the type of business you will run: Taproom-only, self-distribution, wholesale business. Below is a sample listing of operating expenses for a taproom only brewery.

Loan payments and EBITDA

Monthly loan payments will be based on how much you borrow, the interest rate and how long you have to pay it back. For example, a $500,000 loan at 5 percent interest with a seven-year re-payment period works out to a payment of $10,000 per month. To determine if the brewery will produce enough cash to pay back the loan, the monthly payments are compared to EBITDA.

EBITDA stands for Earnings Before Interest, Depreciation and Amortization. It is a measurement that banks and investors use as a form of modified cash flow. In short, the amount of projected EBITDA should be higher than the expected loan payments. This shows the bank (and you) that the loan can be re-paid.

Wrap up + action items

A financial feasibility plan will help you determine if the brewery will make enough money to pay the bills, cover the loan payments and provide a good return on your investment in the business. To build your numbers, start with the four major sections

- Sources and uses plan

- Sales and margin forecast

- Operating expense schedule

- Loan payments and EBITDA

Each section of the plan fits together like pieces of a financial puzzle. Once complete, the picture will reveal how your brewery can be financially successful.

Kary Shumway is the founder of Beer Business Finance and Craft Brewery Finance, online resources for beer industry professionals. Shumway has worked in the beer industry for more than 20 years as a certified public accountant, chief financial officer for a beer distributor, and currently as CFO for Wormtown Brewery in Worcester, Mass. Craft Brewery Finance publishes a weekly beer industry finance newsletter, offers guide books on topics such as cash flow planning and basic budgeting, and an online course to improve taproom profits. The newsletter with a free four-week trial, industry guides and resources are all available at www.CraftBreweryFinance.com.

Brian Abbott says

Kevin Blum Connor Almon-Griffin