I remember attending the Craft Brewers Conference in 2014, writing about a change to the Brewers Association definition of “craft brewer,” and the Brewers Association’s goal of 20 percent market share by 2020 and feeling like that was a big story. And it was, at least when judged by headlines and outside industry interest, which is mainly how a story’s bigness is judged. A lot of WATCH OUT FOR THE CRAFT BEER TREND stories were spun from there.

But I also remember talking to a buddy who was at the conference doing research to start his own craft brewery, and he couldn’t have been less interested. “That really has nothing to do with me.”

Seems weird that this big story about craft brewing wasn’t that important for the people working and growing inside the core of the industry. I thought of this again after the recent “flat craft beer sales data” came out. Here is our look at that data and why it isn’t the whole picture.

We often kind of poke at the somewhat arbitrary bounds of the craft beer definition (and wonder how useful it is), but here is a case where the definition is a problem, or at least how that definition is used to also define success and failure. Putting Sam Adams and Yuengling in the same category of an Apocalypse Brew Works or Platform Beer Co., whether it makes sense or not, creates two big numbers upon which to judge craft beer’s explosive growth: market share and number of breweries. Both are fun numbers, both can tell you how the “trend” is advancing, but those two numbers also have little to do with the other.

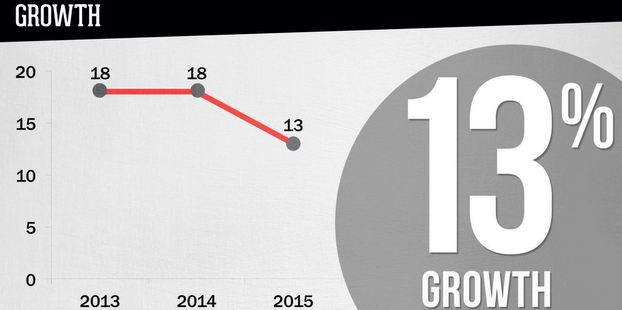

So, OK, the big pool market share number of all the companies you’ve deemed to be craft beer are seeing less growth in sales. Interesting data point. But it seems like a stretch to paint with a big brush and cover up numbers like these, shared by Brewers Association economist Bart Watson:

Probably, says Bart Watson, an economist for the Brewers Association. New brewery openings outnumber closings nearly 10 to 1, Watson says. And the industry, which adds around $55 billion a year to the U.S. economy, now helps support 424,000 jobs.

But some parts of the country have become pretty crowded — perhaps overcrowded — with new breweries, Watson says. San Diego County, Calif., has more than 110 breweries, and Portland, Ore., has 60, just in the city proper. “Those places are really pushing the limit,” he says.

The craft beer movement largely started in the West, Watson notes, and is now moving eastward. That’s partly because state regulation of alcohol was strongest in the East after Prohibition and has been loosened more slowly. So, Watson says, in the East and the Southeast, there’s lots more room for craft beer to grow.

And Watson offers another statistic that should ease concerns about a brewery bubble forming: There are about 8,000 wineries in the United States, and, he says, “Americans drink a lot more beer than they drink wine.”

The “craft beer trend” isn’t thriving or dying based on the fluctuations of that market share number because that thing is artificially inflated by the companies cherry picked to fill it out. And for some of the “real craft beer” companies that sit at the top (like a New Belgium or Stone) there is likely a ceiling for what they can do, and since these are unprecedented times for a growing industry, those early pioneers are going to find that ceiling and growth will stall. This is just inevitable and is already happening. Thus the headlines, but that’s their separate challenge.

But that 4,200+ number is always the number that matters the most because that is really what craft beer is: small, local purveyors. That number represents the solidifying of jobs, community and culture. Maybe a brewery from one region of the country not being able to endlessly grow throughout the entire country, while small, local breweries are popping up everywhere and staying open, is exactly what proves the “craft beer trend” is thriving now more than ever.

How you define craft beer determines whether it is ‘slowing’ or not https://t.co/B2jdKYISb7

Columbus Brew Adventures liked this on Facebook.

“How you define #craftbeer determines whether it is ‘slowing’ or not” https://t.co/cK2PMcHtwj #beer #feedly

How you define craft beer determines whether it is ‘slowing’ or not https://t.co/2VqNAF8VJw via @craftbrewingbiz

Only the growth is slowing.