Three months after the Small Brewer Reinvestment and Expanding Workforce Act (Small BREW Act) was reintroduced in the House of Representatives as H.R. 494, the Brewers Association (BA) announced that the Senate version of the Small BREW Act, S. 917, was reintroduced by Senator Ben Cardin (D-Md.) and Senator Susan Collins (R-Me.).

The Small BREW Act seeks to recalibrate the federal beer excise tax that small brewers pay on every barrel of beer they produce, reflecting the evolution of the overall brewing industry. An earlier iteration of the bill, S. 534, was introduced in 2011 during the 112th Congress and enjoyed bi-partisan support.

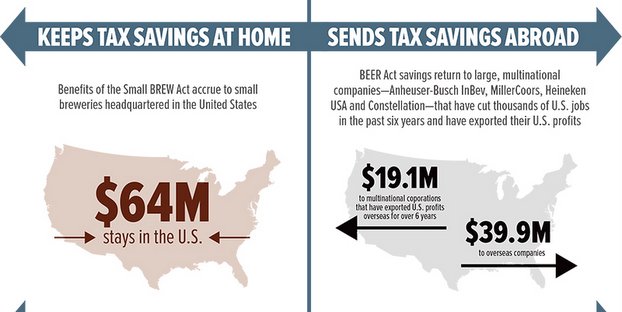

Under current federal law, brewers making less than 2 million barrels (bbls) annually pay $7 per barrel on the first 60,000 bbls they produce and $18 per bbl on every barrel thereafter. The Small BREW Act seeks to recalibrate that rate so that the smallest brewers and brewpubs would pay $3.50 on the first 60,000 bbls. For production between 60,001 and 2 million bbls the rate would be $16 per barrel. Any brewer that exceeds 2 million bbls (about 1 percent of the U.S. beer market) would begin paying the full $18 rate. Breweries with an annual production of 6 million bbls or less would qualify for these tax rates.

“Small brewers have been anchors of local communities and America’s economy since the start of our history. In addition to making high-quality beers, craft brewers, including those in Maryland, create jobs and reinvest their profits back into their local economies,” said Senator Cardin, a member of the Senate Finance and Small Business committees. “The federal government needs to be investing in industries that invest in America and create real jobs here at home. With more than 2,400 small and independent breweries currently operating in the U.S., now is the time to take meaningful action to help them and our economy grow.”

“Maine is home to dozens of unique craft breweries and brewpubs that invigorate our economy by providing more than 1,000 jobs and drawing countless tourists into our state,” Senator Collins said. “In meeting with brewers across Maine, they always make clear to me how federal tax policy affects their businesses. This bill, which I support, would help reduce the tax burden placed on many small brewers across our country, allowing them to thrive, create jobs and further grow our economy.”

Nationally, small and independent brewers employ over 108,000 full- and part-time employees, generate more than $3 billion in wages and benefits, and pay more than $2.3 billion in business, personal and consumption taxes. Adjusting the tax rate would provide small brewers with an additional $60 million per year. This money would be used to support significant long-term investment, job creation and economic expansion by growing their businesses regionally or nationally.

“Small brewers nationwide appreciate the leadership from Senator Cardin and Senator Collins on this issue and their unwavering support of the craft brewing community,” added Bob Pease, chief operating officer, Brewers Association. “We look forward to working with them and their Senate colleagues on the passage of this legislation, which will undoubtedly benefit our economy in the near and long term.”

Small BREW Act reintroduced into the Senate – Craft Brewing Business http://t.co/eksa44cJT2

RT @CraftBrewingBiz: Small BREW Act reintroduced into the Senate. @BrewersAssoc #CraftBeer http://t.co/1zsu5SfPqO

RT @CraftBrewingBiz: Small BREW Act reintroduced into the Senate. @BrewersAssoc #CraftBeer http://t.co/1zsu5SfPqO