As a result of two unrelated investigations into sponsorship agreements that allegedly resulted in the unlawful exclusion of their competitors’ products, the Alcohol and Tobacco Tax and Trade Bureau (TTB) accepted $225,000 Offers in Compromise (OIC) from Robert “Chick” Fritz, Inc. of Belleville, Illinois and from Doll Distributing LLC of Des Moines, Iowa.

The more interesting of the two is Doll Distributing, which entered into a sponsorship agreement that “in part controlled the distribution of malt beverages at Drake University’s Knapp Center during the 2018 and 2019 Drake University basketball season.”

The investigation revealed that somewhere in that timeframe “Doll Distributing negotiated sponsorship of Drake University’s athletic programs as the official domestic beer sponsor. A feature in the agreement was that in exchange for $49,500, Doll Distributing was the exclusive distributor of non-craft beer at the Knapp Center. It is TTB’s position that Doll Distributing LLC’s participating in the sponsorship agreement excluded competitors and therefore violated the Federal Alcohol Administration’ Act’s tied house and exclusive outlet prohibitions.”

The investigation also identified mobile beer carts that were provided free of charge and used exclusively to distribute Doll Distributing products.

So, there you go. The system sometimes works.

What’s an Offer in Compromise?

Titles 26 and 27 of the United States Code contain provisions for the compromise of certain civil and criminal cases. In this context, a compromise is an agreement made between the Government and an alleged violator in lieu of civil proceedings or criminal prosecution. TTB generally considers offers in compromise for any violation of the laws and regulations it administers, and TTB will provide appropriate assistance to any person or business that wishes to make an Offer in Compromise.

More about the Trade Investigations Division

The TTB’s TID provides assistance and advice about the provisions of the Federal Alcohol Administration Act, the Internal Revenue Code, and all related regulations to TTB employees, other federal and state agencies, members of the alcohol and tobacco industries, and the public.

TID investigators:

- Ensure only qualified applicants are granted permits to engage in the production and distribution of alcohol and tobacco.

- Investigate allegations of trade practice violations in the marketplace.

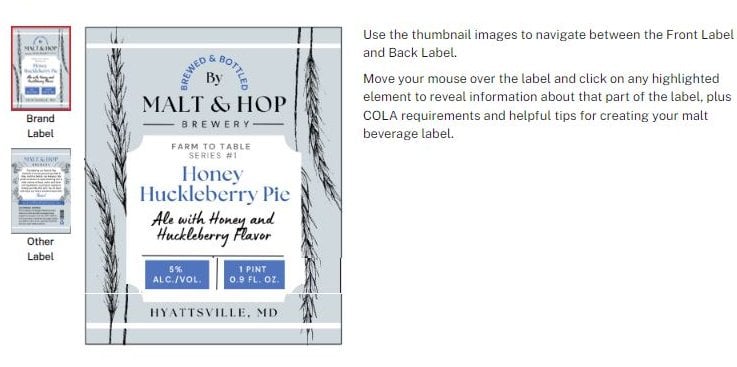

- Examine Certificates of Label Approvals (COLAs) to deter unauthorized usage.

- Promote voluntary compliance with the laws and regulations enforced by TTB.

- Prevent misleading labeling and advertising of alcohol beverages.

- Insure public safety by responding to credible information suggesting a health-related contamination or adulteration of an alcohol product.

- Conduct investigations of suspected alcohol or tobacco tax evasion.

Leave a Reply

You must be logged in to post a comment.