Over the last 40 years, IWSR has built up the world’s largest database on the beverage alcohol market. It claims to understand the market, category and brand performances of products in 157 countries across the world using local market input. Occasionally, IWSR releases market reports, and occasionally we run those market reports because we find them interesting and insightful. Here’s one right now!

The meteoric rise of the hard seltzer category across the U.S. beverage alcohol industry has been nothing short of phenomenal, and a comprehensive new Hard Seltzer Report from IWSR Drinks Market Analysis, the leading source of beverage data, forecasts that consumer interest in these products will only continue to grow.

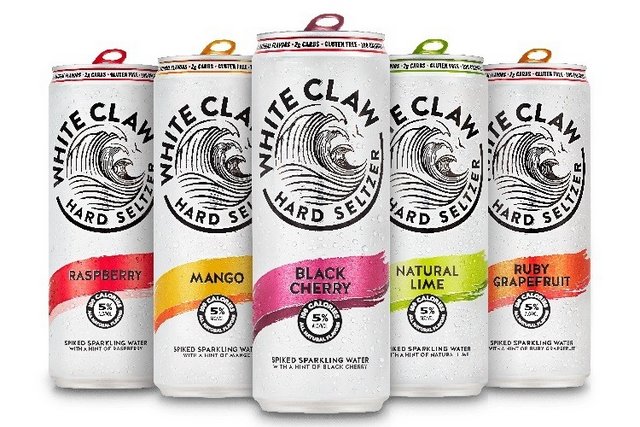

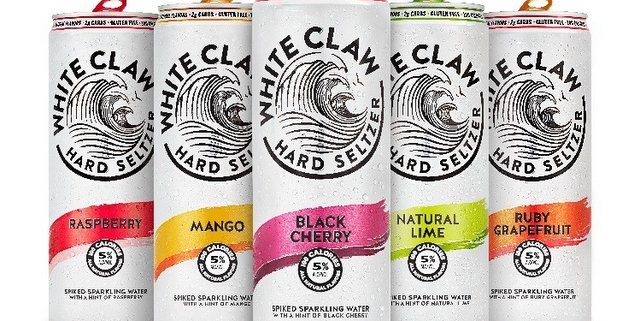

Led by the brands White Claw and Truly, hard seltzer volume in the United States is currently about 82.5m nine-liter cases (which is already larger by volume than the leading spirits category in the United States, which is vodka). IWSR forecasts that by 2023, the category will more than triple, to reach over 281m cases. Hard seltzer and other “seltzer-like” products command a market share of 2.6 percent of all beverage alcohol in the United States, up from only 0.85 percent a year ago. IWSR also estimates that hard seltzer ecommerce sales will increase from a current share of 0.8 to nearly 2 percent by 2023 as more consumers realize they can purchase these products online.

The IWSR Hard Seltzer Report is also the first study of its kind to define, examine and quantify the size of the entire hard seltzer universe, a category which not only includes malt-based products but also those produced from wine and spirits. These seltzer-like products, with similar product attributes as leading malt-based brands, add another 7m cases to the total seltzer universe in the US.

“Hard seltzers are far from a fad, they’re growing at a spectacular rate, and increasingly, hard seltzer producers are pulling consumers from other beverage alcohol categories, not just beer. Combined, hard seltzers and other canned seltzer-like products [vodka soda, as an example] will drive the total ready-to-drink category, making it the fastest-growing beverage alcohol category in the United Sstates over the next five years,” said Brandy Rand, COO of the Americas at IWSR Drinks Market Analysis.

IWSR also conducted a consumer opinion and attitude study about hard seltzers, and found that over half (55 percent) of U.S. alcohol consumers surveyed drink them regularly, at least once a week. The research also shows that while hard seltzers appeal to younger generations of consumers, the category spans all ages and demographics, reaching a broader segment of the population. Consumers cited “refreshment” as the top hard seltzer attribute that appeals to them.

“The rise of hard seltzers shows there was a segment of consumers underserved by the current beverage alcohol market who were looking for alternatives that were refreshing and flavorful, but also low-calorie and low-sugar,” added Rand. “These products also meet the growing consumer demand for convenience and appeal to people that enjoy popular cocktails like the vodka soda and wine spritzers. We definitely expect to see more brands taking advantage of this fast-growing trend.”

In addition to chronicling the rise, future forecast and consumer attitudes related to hard seltzer products, the report also examines leading brands and innovation. Outside of the United States, the study details international opportunities for the hard seltzer category across key markets like Canada, Brazil, Japan and South Africa, to name a few. With on-the-ground insights, the IWSR looks at market dynamics that may affect the success of alcoholic sparkling waters in the United Kingdom, as an example, which are already making inroads as the U.S. trend expands globally.

Lewis Rivers says

Now people need to start supporting the craft seltzer breweries and leave the big national brands for the places that don’t have craft brewed options.

Marty Nader says

I have never seen anyone drink a hard seltzer. Ever. I must live under a rock. Hard seltzer must be a big-city trend.