What a difference a year makes for Boston Beer. You may recall the big bet it made last year to meet anticipated hard seltzer demand that never materialized. According to the Q3 2022 earnings report, that added up to about $133 million in direct and indirect costs that were recorded in the third quarter of 2021 that did not show up on this year’s spreadsheet.

As result, Q3 2022 shows a net income of $27.3 million compared to a net loss of $58.4 million last year.

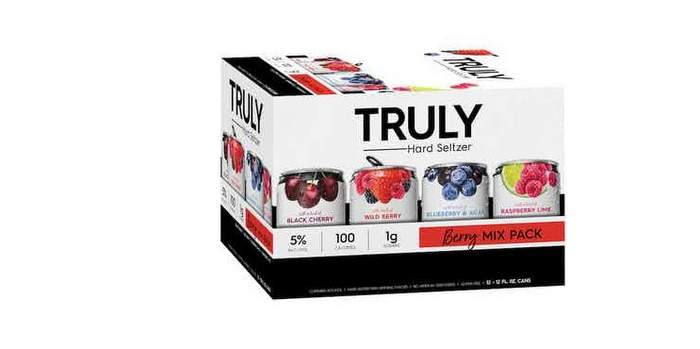

However, depletions have not improve. Depletions decreased 6 percent from the prior year, reflecting decreases in Truly Hard Seltzer, Angry Orchard, Samuel Adams, and Dogfish Head brands, partially offset by increases in its Twisted Tea and Hard Mountain Dew brands.

And again, this sad trombone is still mostly on Truly: excluding the Truly declines, the company’s depletion volumes for the remainder of its business in the third quarter actually increased 14%.

“I continue to be optimistic about the long-term growth outlook for Boston Beer’s diversified beverage portfolio,” said Chairman and Founder Jim Koch. “Based on our year-to-date performance and our view on the remainder of the year, we have narrowed the range of our fiscal 2022 financial guidance. As we continue to navigate through this dynamic operating environment, we remain committed to investing in innovation and brand support across our Beyond Beer portfolio. We operate in attractive segments and believe our strong capabilities – combined with the top salesforce in beer – position us well to deliver long-term value.”

The company believes distributor inventory as of September 24, 2022 averaged approximately five weeks on hand and was at an appropriate level for each of its brands. The company expects distributors will keep inventory levels for the remainder of the year between four to five weeks on hand.

“We delivered revenue, shipment and cash flow growth in the third quarter, with strong pricing performance across our portfolio, continued growth in depletions and shipments in Twisted Tea, and positive early progress in Hard Mountain Dew,” said President and CEO Dave Burwick.

And as for Truly, a pivot into the ready-to-drink category might help it find new footing.

“We launched Truly Vodka Seltzer earlier this month and we are continuing to execute on our plans to support the base Truly business,” Burwick stated. “We remain focused on delivering our strategy to create a broad beverage portfolio with many pathways to growth while optimizing our supply chain to expand margins over the long term.”

Leave a Reply

You must be logged in to post a comment.