According to the Brewers Association and Nielsen Harris data, the portion of adults who enjoy craft beer rose to an all-time high of 44% in 2020 (shooting up from 35% in 2015). The COVID-19 pandemic has played a big role over the past year, with more people than ever opting to order beer from the comfort and safety of home.

Though beer e-commerce is relatively new, Tavour has been an industry leader since 2013. Working with over 600 of the nation’s independent breweries, the app-based service allows craft fans to access beers they can’t find locally. Tavour closely examines its inventory data and brewery trends each month. Here are the top trends as of March 2021:

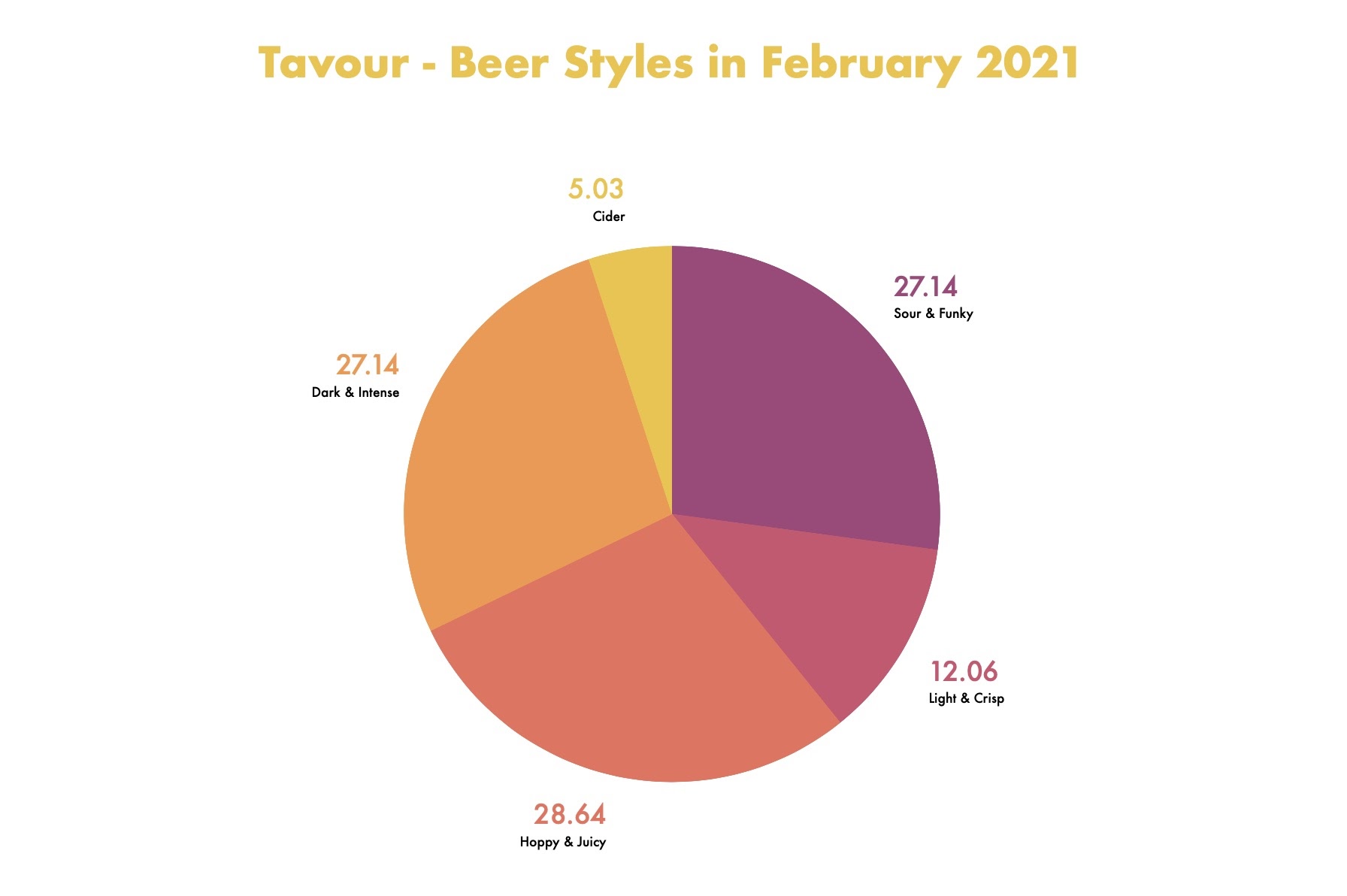

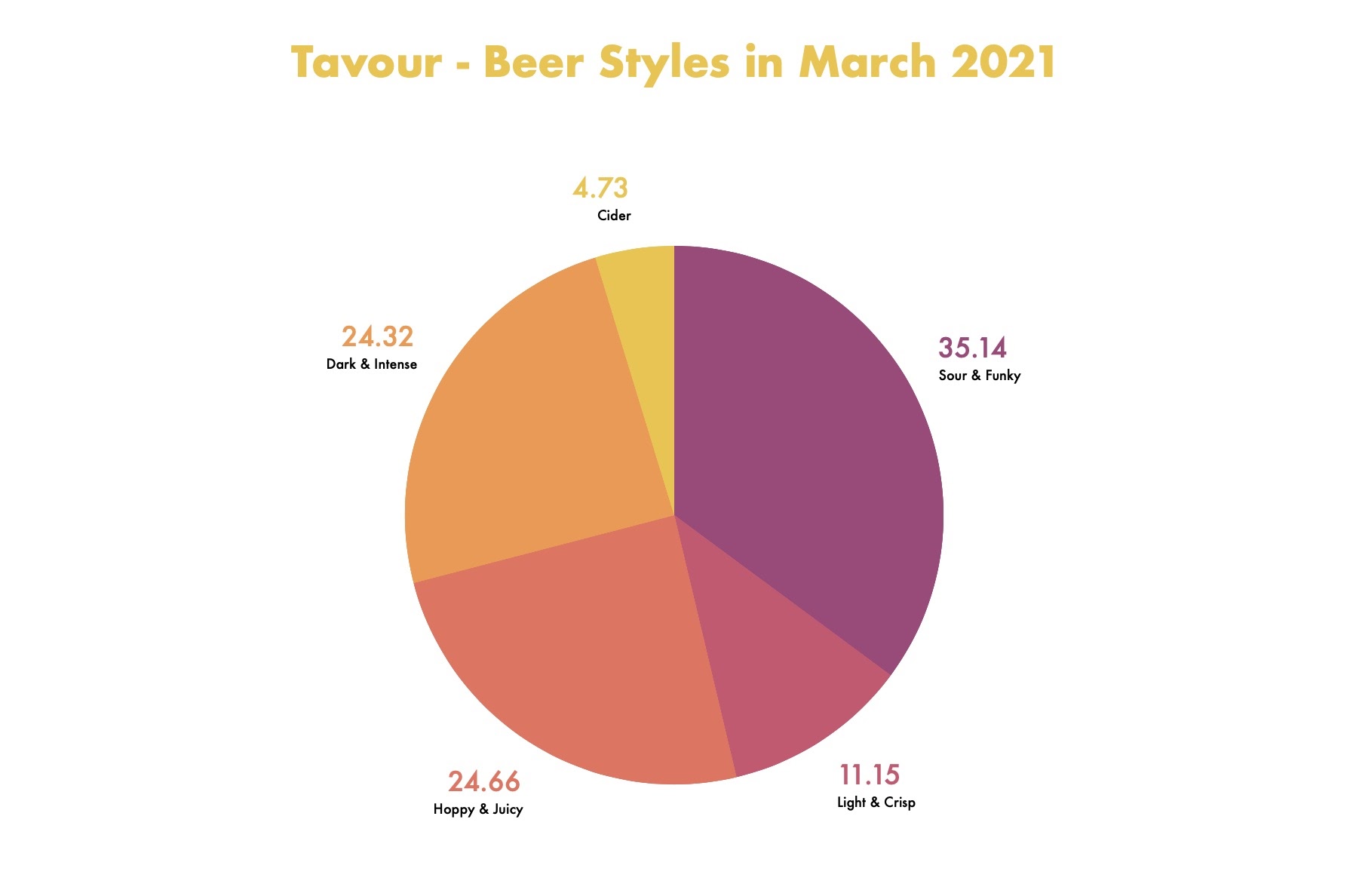

Style Popularity: Sour and Funky tops Hoppy and Juicy

Tavour organizes the beers they receive into specific style categories:

- Hoppy & Juicy – IPAs, Pale Ales, aggressively hopped styles

- Dark & Intense – Stouts, Porters, Barleywines, certain Meads, other dark and high ABV styles

- Sour & Funky – Sour Ales, Wild Ales, Farmhouse styles

- Light & Crisp – Pilsners, Lagers, Golden Ales, Kölsch, Hard Seltzers, other light styles

- Cider – Hard Ciders

Hoppy & Juicy styles led throughout February, but March saw exponential growth in the percentage of Sour & Funky styles appearing on the app. Most style categories nevertheless held steady between the two months.

The Top-Selling Beers

Three of the top-five selling beers in March were Fruited Sours, which is unsurprising considering the notable growth in the portion of Sour & Funky styles offered on the app overall. The three beers came from Drekker Brewing Co., a Midwest brewery with a reputation for heavily fruited Sour styles.

Nevertheless, the top two selling beers for the month were an Imperial Stout and a Wheatwine, both falling in the Dark & Intense category:

- Sent By Liars Imperial Stout – Anchorage Brewing, Anchorage, AK

- MIRE Wheatwine – Lua Brewing, Des Moines, IA *Brand-new brewery to Tavour

- Slang Du Jour Raspberry Cheesecake Fruited Sour – Drekker Brewing, Fargo, ND

- Chonk Mango Marshmallow Fruited Sour – Drekker Brewing, Fargo, ND

- Slang Du Jour – Mango Apricot Cobbler Fruited Sour – Drekker Brewing, Fargo, ND

It’s worth noting that the top-selling beer in February also came from Anchorage Brewing (The Explorer Imperial Stout).

These were the top-selling beers by style category (some entries above repeated below for clarification):

- Sour & Funky – Slang du Jour Raspberry Cheesecake Fruited Sour – Drekker Brewing, Fargo, ND

- Hoppy & Juicy – Juicy Bits New England IPA – WeldWerks Brewery, Greeley, CO

- Dark & Intense – Sent By Liars Imperial Stout – Anchorage Brewing, Anchorage, AK

- Light & Crisp – Be Patient India Pale Lager – Anchorage Brewing, Anchorage, AK

- Cider – Blueberry Spaceship Box – Superstition Meadery, Prescott, AZ

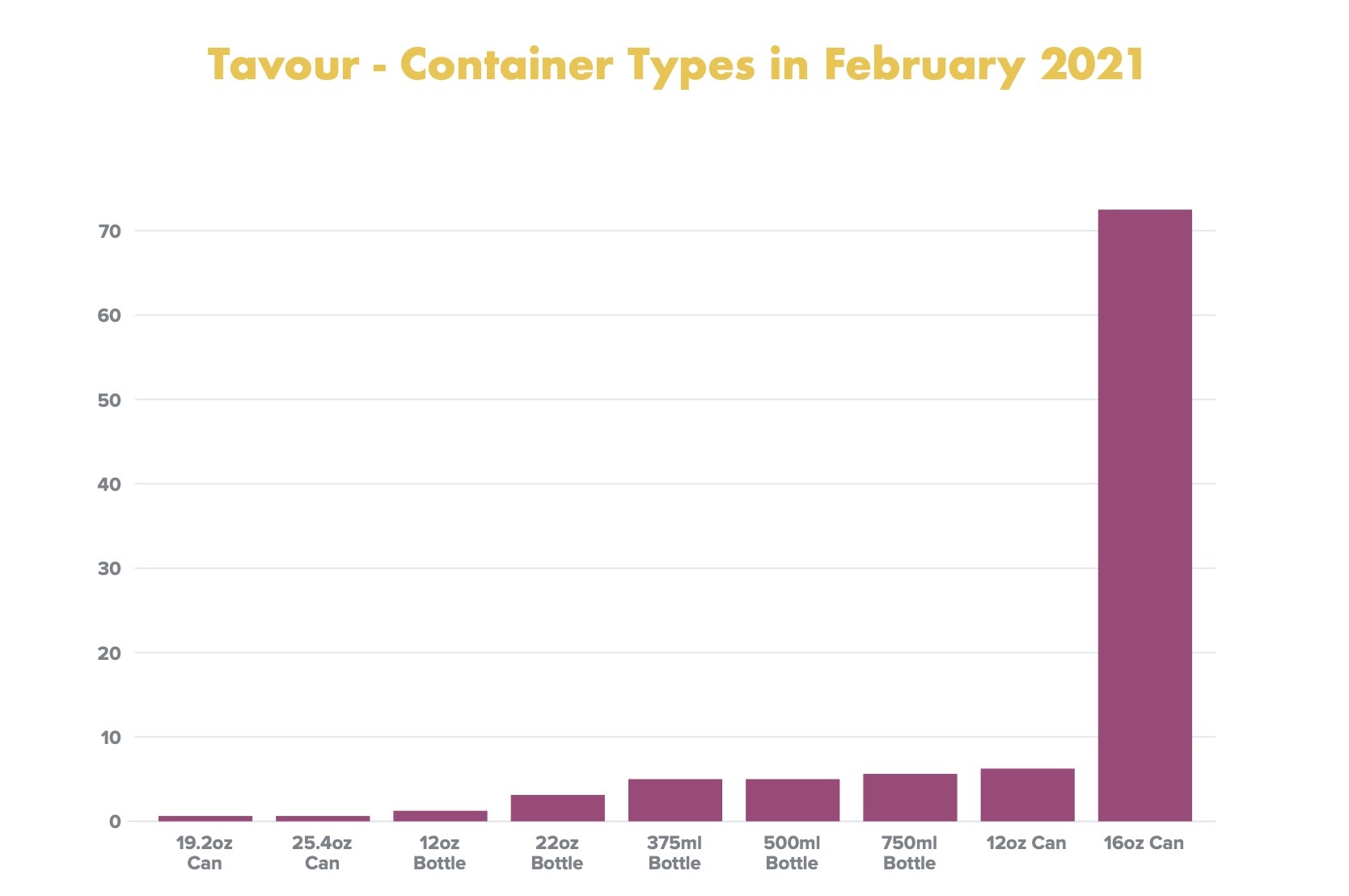

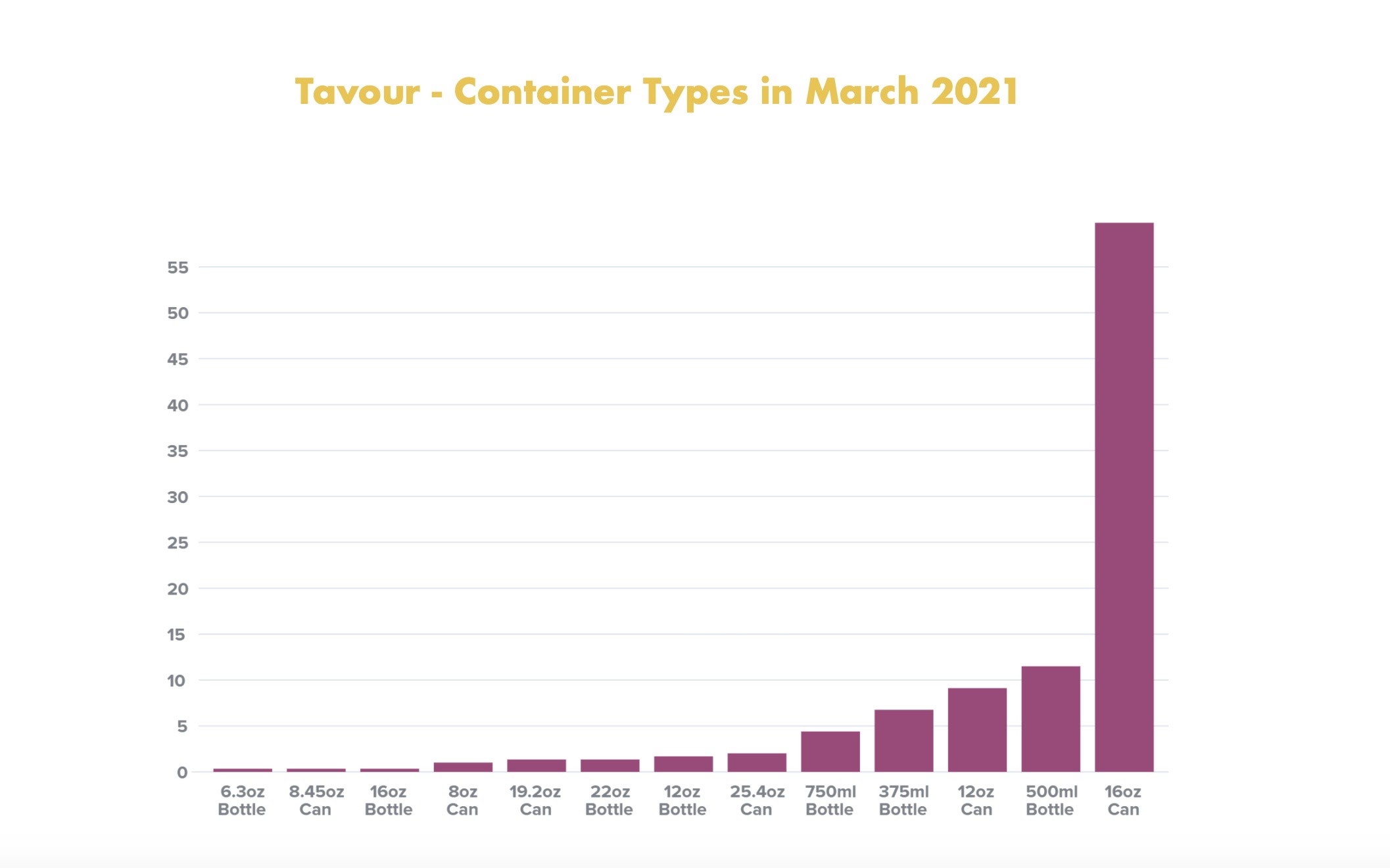

16 oz. Cans Remain on Top

The COVID-19 crisis sparked a can shortage from coast to coast. As the Tavour team learned from communications with breweries, however, the shortage is largely around 12 oz. cans rather than other sizes, prompting breweries like Colorado’s Odd13 and Texas’ 903 Brewers to switch permanently to 16 oz. cans by the end of 2020. Others, like New York’s Evil Twin and Ohio’s Hoppin’ Frog, used some 8 oz. cans in late 2020, though these were not seen in February.

From February to March, 16 oz. cans remained the dominant container. But in addition to the seldom-spotted 8 oz. cans, some brand-new containers made their way out: 6.3 oz. bottle, 8.45 oz. can, and 16 oz. bottle. This resulted in a percentage slip for 16 oz. cans, moving from 72.5% of the total amount of containers in February to 59.8% in March. Interestingly, the amount of 500ml bottles more than doubled, going from 5% in February to 11.5% in March.

(Quantities are shown in percentages)

Time will tell if 16oz cans remain the container of choice, as Ball Corporation (one of the biggest aluminum industry leaders) is poised to begin production with a new canning plant in Pennsylvania in mid-2021, along with another in Europe set to open in 2022.

What Will We See in April?

The data from March shows a few emerging trends that could continue throughout the rest of Spring and into Summer:

- Though individual Dark beer styles are top-sellers, Sour & Funky styles may continue to rise overall. Hoppy & Juicy popularity could continue to wane if current trends continue.

- 16 oz. cans are likely to remain the container of choice for many breweries, but they may not retain as strong of a lead as in the past.

- More breweries from around the U.S. may start sending beer through Tavour to expand their customer base.

Leave a Reply

You must be logged in to post a comment.