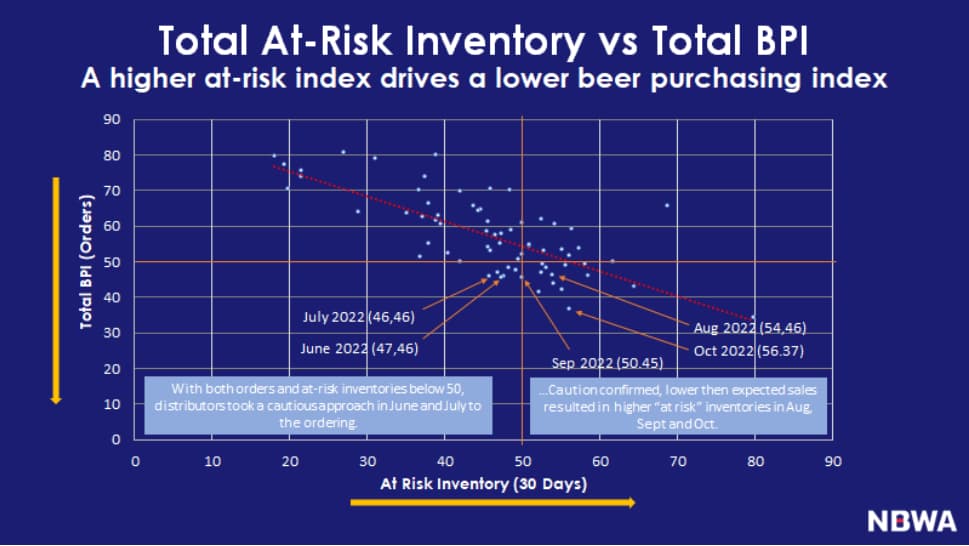

The Beer Purchasers’ Index (BPI) for October 2022 shows the total beer index at 37 and the “at-risk” inventory at 56. The October data from the National Beer Wholesalers Association (NBWA) marks a pessimistic start to the fourth quarter of 2022 for the industry.

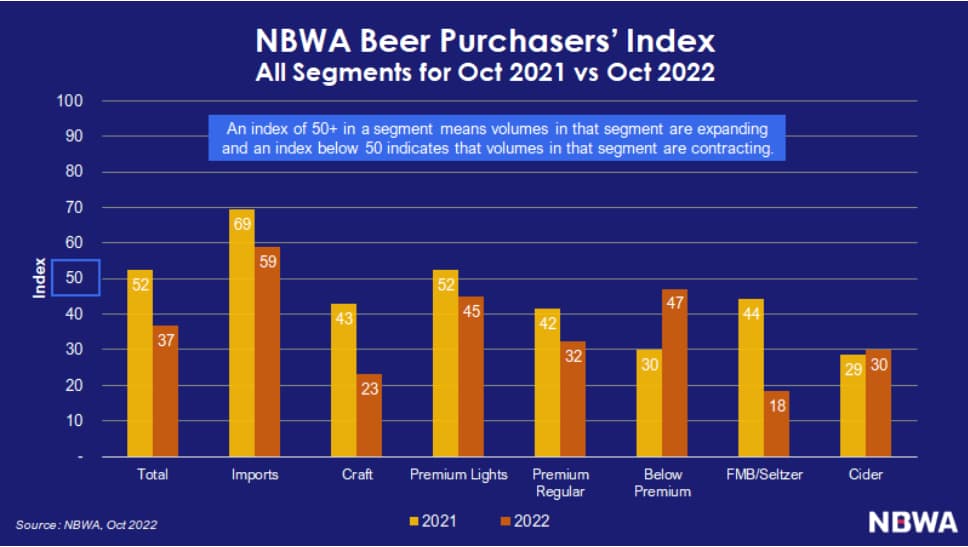

BPI is the only forward-looking indicator for distributors to measure expected beer demand. The index surveys beer distributors’ purchases across different segments and compares them to previous years. A reading greater than 50 indicates the segment is expanding, while a reading below 50 indicates the segment is contracting.

Continued inflationary pressures and a slowing economy bring the industry to a fifth month of pause after five months of positive ordering trends in 2022.

Looking across the segments for October:

- The imports index stands as the only beer segment in expansion territory with a reading of 59 in October 2022, lower relative to the October 2021 reading of 69.

- The craft index at 23 remains well below the October 2021 reading of 43.

- The premium lights index posted a reading of 45, slightly below the October 2021 reading of 52.

- The premium regular segment index is at 32, below the October 2021 reading of 42.

- The below premium segment at 47 is significantly above its October 2021 reading of 30. For a fifth month in a row, below premiums have posted higher readings year-over-year.

- The FMB/seltzer index continues to contract, falling to 18 in October 2022 from the October 2021 reading of 44.

- Finally, the cider segment index at 30 for October 2022 is about the same reading as October 2021 at 29

Leave a Reply

You must be logged in to post a comment.