The Economist is one of the most prestigious publications in the world, and when we’re not reading about brew news, we’re often pursuing those pages of the famous London-based international affairs magazine. This week, The Economist posted a nice feature article on the craft brewing industry in America, talking about Big Beer vs. Craft and the Brewers Association vs. Beer Institute on the excise tax (among other things).

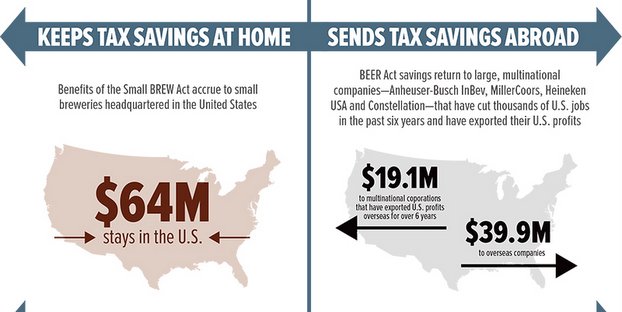

Way back in February, as the 113th Congress got underway, we noted the reintroduction of H.R. 494, the Small Brewer Reinvestment and Expanding Workforce Act (Small BREW Act) in the House of Representatives. The bipartisan legislation, which was reintroduced by Representatives Jim Gerlach (R-Pa.) and Richard E. Neal (D-Mass.), seeks to re-calibrate the federal beer excise tax that small brewers pay on every barrel of beer they produce.

Under current federal law, brewers making less than 2 million barrels (bbls) annually pay $7 per barrel on the first 60,000 bbls they brew, and $18 per barrel on every barrel thereafter. The Small BREW Act would create a new rate structure that reflects the evolution of the craft brewing industry. The rate for the smallest brewers and brewpubs would be $3.50 on the first 60,000 bbls. For production between 60,001 and 2 million bbls the rate would be $16 per barrel. Any brewer that exceeds 2 million bbls (about 1 percent of the U.S. beer market) would begin paying the full $18 rate. Breweries with an annual production of 6 million bbls or less would qualify for these tax rates.

Two big brewing associations sit on opposite sides of the fence. We let The Economist continue:

As the craft-beer industry grows, the Brewers Association thinks more of its members will join Boston Beer on the wrong side of the tax code. So it is pushing Congress to pass a bill that would raise the excise-tax bar to 6 million barrels a year. In March, hundreds of small-brewery owners took their case to Congress. But the Beer Institute, which represents big and small brewers alike, unsurprisingly favors a different bill that would cut the excise tax for the whole industry.

Opponents of slashing the excise tax, which has not been adjusted since 1991, note that inflation has already reduced its potency. Moreover, some see higher alcohol taxes as a way to increase revenues. But others are sympathetic to the Beer Institute’s claim that taxes have become the most expensive ingredient of beer. Hence, perhaps, the bitter taste of some brews.

The article’s titled “A Brewing Fight” and is definitely worth a read. We’ll keep you updated on the excise tax as more information becomes available.

Leave a Reply

You must be logged in to post a comment.